Introduction: Google Business Profile Insurance Field

A Google Business Profile is a powerful tool for businesses, including those in the insurance field. It helps insurance agents and companies become more visible to potential customers, especially in local searches.

With more people turning to Google to find nearby services, setting up a Google Business Profile can make a huge difference for insurance providers.

What is Google Business Profile?

Google Business Profile (formerly Google My Business) allows businesses to manage their online presence across Google, including Search and Maps.

For the insurance field, having an optimized profile can help attract more clients, especially as people search for insurance agents, brokers, or specific types of insurance like auto, health, or life insurance.

Why Visibility Matters for Insurance Providers

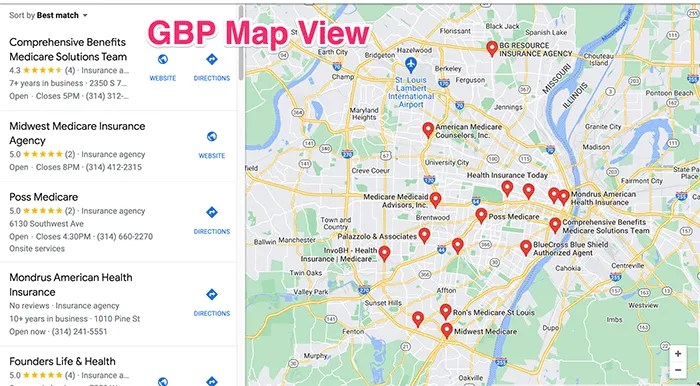

Insurance agents and companies often compete for local clients, and appearing in local search results is critical. When a person searches for an insurance provider near them, a Google Business Profile can place your services in the spotlight, making it easier for prospects to find you.

Without it, your business could be overlooked in favour of competitors who have optimized their profiles.

A Google Business Profile not only provides basic contact information but also allows you to list services, add reviews, and even showcase promotions. This can significantly increase your chances of standing out and gaining trust from potential clients.

As seen in many cases, like that of McDade Insurance Brokerage, businesses that focus on optimizing their Google Business Profile often experience higher engagement and a steady flow of leads.

By following best practices like listing all types of insurance services, updating hours, and encouraging reviews, insurance businesses can transform their profile into a client-attracting magnet.

Benefits of Google Business Profile for Insurance Providers

| Benefit | Description |

|---|---|

| Local Visibility | Appears in local search results, improving chances of discovery |

| Increased Trust | Positive reviews and business information build credibility |

| Service Promotion | Display insurance services, types of coverage, and specialties |

| Direct Contact | Easy-to-find phone number, website link, and office hours |

| Engagement with Clients | Post updates, promotions, and answer client questions |

Optimizing your Google Business Profile is crucial in the competitive insurance field, where local visibility and client trust are key. So, make sure your profile is up-to-date and complete to get the best results from local searches.

What is a Google Business Profile for Insurance Companies?

A Google Business Profile (formerly known as Google My Business) is an essential tool for insurance agents and companies to improve their visibility in local searches.

It allows businesses to manage how they appear on Google Search and Maps, making it easier for customers to find and interact with them.

Definition and Purpose

A Google Business Profile is a free online tool that helps insurance agents or brokers showcase their business details. By creating and managing a Google Business Profile, an insurance company can display key information such as its location, contact details, services, hours of operation, and customer reviews directly on Google.

The purpose of having a Google Business Profile in the insurance field is to enhance local visibility, making it easier for potential clients to find an insurance agent or company when they search for related services like “car insurance near me” or “home insurance agent.”

Features and Benefits

Here are some of the core features of a Google Business Profile and how they help insurance agents or brokers:

| Feature | How It Helps Insurance Companies |

|---|---|

| Business Information | Shows essential details such as name, address, phone number, and hours. This ensures customers can reach you easily. |

| Reviews and Ratings | Positive customer reviews help build trust and credibility, making it more likely that potential clients will choose your services. |

| Google Posts | Allows you to share offers, news, and updates, helping you stay top-of-mind with clients and potential clients. |

| Location on Google Maps | Helps insurance agents be found on Google Maps, improving local visibility and making it easier for clients to visit or contact you. |

| Q&A Section | Allows you to answer common questions, provide information and build customer trust before they even contact you. |

| Analytics | Provides insights on how clients find your business, allowing you to fine-tune your marketing efforts and improve local SEO. |

By setting up a Google Business Profile, insurance companies can reach people who are actively searching for insurance services nearby. This is especially important in the insurance field, where many customers are looking for local agents they can trust.

By optimizing your Google Business Profile, you increase the chances of appearing in the local search results, which is crucial for attracting new clients.

In summary, having an optimized Google Business Profile in the insurance field can significantly improve an insurance company’s visibility, credibility, and customer engagement, ultimately leading to more clients and better business outcomes.

Why is a Google Business Profile Crucial in the Insurance Field?

A Google Business Profile is a powerful tool for insurance companies, as it greatly enhances local SEO efforts. Local SEO is the practice of optimizing your online presence to attract potential customers in your local area.

For insurance agents or companies, this means showing up in local searches when clients are looking for services nearby.

Google Business Profiles help insurance businesses increase visibility, appearing in search results and on Google Maps. This means more clients can find you easily when they search for insurance services in their region.

A well-optimized Google Business Profile also plays a crucial role in building trust with potential customers. Customers trust businesses that have complete and accurate information.

When your profile is optimized, with detailed business hours, contact details, and customer reviews, you stand out as a trustworthy and reliable option. High ratings and positive reviews are particularly important in the insurance field, where customers are seeking reliable service. 84% of customers check reviews before making a decision.

Moreover, a Google Business Profile allows insurance companies to engage with clients directly. Through Google Posts, you can share updates about your services, promotions, or new offers. This helps keep your audience engaged and informed.

In summary, a Google Business Profile in the insurance field improves visibility, boosts local SEO rankings, enhances credibility, and fosters direct communication, all of which can lead to more leads and stronger customer relationships.

Key Elements of an Optimized Google Business Profile Insurance field

For insurance companies looking to boost their online presence, optimizing a Google Business Profile (GBP) is essential. Here’s how you can ensure your profile is set up to attract potential clients in the Google business profile insurance field:

1. Business Information: Ensuring Accuracy

Your profile should feature the correct and up-to-date business name, address, phone number, and website.

Google uses this data to verify your business and show it to people who are looking for insurance services nearby. Keeping this information accurate helps customers trust your business and makes it easier for them to contact you.

2. Services & Products: Listing Insurance Services

Include a clear list of the types of insurance services you offer, such as life, home, auto, and health insurance. By being specific, you help your business appear in relevant local searches for people seeking these services.

The more detailed and relevant your offerings are, the more likely your business will be discovered in the Google Business Profile insurance field.

3. Reviews: The Importance of Customer Feedback

Customer reviews play a crucial role in building trust and attracting new clients. Studies show that 93% of consumers check reviews before choosing a service. Responding to both positive and negative reviews helps manage your reputation and shows prospective clients that you value feedback.

4. Photos & Posts: Adding Engaging Visuals and Regular Updates

Adding photos of your office, team, and happy clients can help your profile stand out and attract more clicks. Regularly posting updates, promotions, or useful tips keeps your profile fresh and engaging. By maintaining an active profile, you increase the likelihood of appearing in local search results.

By optimizing these key elements, insurance agents can improve their visibility, trustworthiness, and engagement with local clients. This approach will not only enhance local search visibility but also convert potential leads into actual customers.

Advanced Features for Maximizing Your Google Business Profile in the Insurance Field

To make the most of your Google Business Profile insurance field, there are advanced features you can use to stand out and engage with potential clients more effectively.

- Q&A Section

The Questions & Answers (Q&A) feature is a powerful tool for businesses, including insurance agencies. You can manage this section by proactively adding answers to frequently asked questions, and positioning yourself as an expert. This helps create trust and assures potential clients that you are knowledgeable. By encouraging clients to ask questions and providing detailed responses, you can improve visibility and trust. - Tips for Managing Q&A:

- Be the first to answer questions to maintain control of the conversation.

- Respond promptly and thoroughly to each question, providing accurate and helpful information.

- Use the upvote feature to promote useful Q&As, making them more visible to users.

- Posts & Promotions

Google Business Profile allows you to post updates, promotions, and helpful content. This is a great opportunity to share limited-time offers, new insurance packages, or important industry news, keeping your clients informed and engaged. Regularly posting content helps keep your profile fresh and improves your visibility in local searches. - Effective Post Ideas:

- Announce special promotions, such as discounts on car insurance or new packages.

- Share educational content, like tips for choosing the right life insurance or home insurance coverage.

- Post seasonal updates, such as reminders about annual policy reviews.

Using these advanced features on your Google Business Profile will help you connect with your audience, provide valuable information, and ultimately drive more leads to your insurance business.

How to Set Up and Manage a Google Business Profile for Insurance Agents

Setting up and managing a Google Business Profile is crucial for insurance agents and companies looking to enhance their visibility and connect with local clients. Here’s how to do it step-by-step:

Step 1: Creating a Google Business Profile

To get started, visit the Google Business Profile page (google.com/business) and click on “Manage now.” If you don’t have an existing profile for your business, you can add one by selecting “Add your business to Google.” You’ll need to fill in essential details such as:

- Business name: Use your official business name, not a keyword-stuffed name.

- Business type: Choose whether your business is a local store or a service-area business.

- Contact info: Provide a working phone number and website if applicable.

Once you’ve added the basic details, Google will send a verification postcard to your business address for confirmation.

Step 2: Adding Business Information

After verification, go back to your profile and update important information such as:

- Address: Ensure your address is accurate. If your business doesn’t have a physical location, you can specify a service area.

- Business hours: List when you’re available for clients.

- Category: Select a category that fits your business (e.g., “Insurance agency”).

- Services offered: List your insurance services, such as life, auto, and home insurance.

Step 3: Optimize and Keep Your Profile Fresh

To maximize your Google Business Profile’s effectiveness:

- Photos and Posts: Regularly upload photos of your office, team, or any relevant visuals. Posting updates and promotions can also keep your profile fresh and engaging.

- Customer reviews: Encourage clients to leave positive reviews and respond to them regularly. This builds trust with potential customers and improves your local SEO.

Step 4: Managing Your Profile

To ensure your Google Business Profile remains relevant:

- Regularly update the details, especially when any changes occur, such as new services or altered working hours.

- Use the Q&A section to answer common client questions and position yourself as an expert in the insurance field.

By following these simple steps and regularly maintaining your profile, you can ensure that your business remains visible in local searches, attract more clients, and build trust in your community.

Case Studies: Insurance Agents Who Succeeded with Google Business Profiles

Using a Google Business Profile effectively can dramatically boost the visibility and success of insurance agents and companies. Several insurance agents have demonstrated impressive growth by optimizing their profiles to increase local search visibility and engagement.

- CV Mason Insurance

A family-owned insurance agency, CV Mason Insurance improved its visibility by optimizing its Google Business Profile and creating a focused content strategy. This led to a remarkable 98% increase in organic traffic and a 102% increase in leads. Their efforts to improve local SEO helped boost both website form submissions and calls from Google. - Fuller Insurance Agency

Fuller Insurance, a multi-location agency, also saw success by optimizing its Google Business Profile. They focused on enhancing their website’s user experience and SEO strategies, which led to a 328.71% increase in organic leads and a 230.69% increase in calls. The profile contributed greatly to their higher local rankings and lead generation. - Artisan Insurance Solutions

Artisan Insurance Solutions, focusing on artisans and contractors, reaped benefits from Google My Business optimization. They worked on improving their NAP (Name, Address, Phone) consistency and built a robust SEO strategy. As a result, they saw a 381.25% increase in form submissions and a 1300% increase in calls, which significantly expanded their online presence.

These case studies highlight the critical role a well-optimized Google Business Profile plays in the insurance field. By using the platform’s features—such as updating business information, engaging with reviews, and posting regularly—insurance agents can see increased traffic, leads, and customer trust.

Conclusion

In the Google Business Profile insurance field, having a well-managed profile brings numerous advantages for businesses looking to grow and thrive. By ensuring that your profile is complete and optimized, your insurance business can stand out in local searches, making it easier for potential clients to find you.

This visibility is crucial as more customers rely on Google to search for services like insurance near their location. By showing up in local search results, you increase your chances of getting more leads and, ultimately, growing your business.

Moreover, a Google Business Profile insurance field helps build trust with potential clients. When people see positive reviews, your business information, and updates, it establishes credibility, which is key to attracting customers.

Reviews, regular posts, and engaging with clients on your profile can lead to better relationships with your target audience, enhancing your reputation.

Setting up or optimizing your Google Business Profile is not just about appearing on a map; it is about leveraging local SEO to create a better connection with people who are actively looking for insurance services.

So, if you haven’t already, it’s time to set up your profile or make sure it’s fully optimized. This simple step can have a huge impact on your local SEO and lead generation efforts. With the Google Business Profile insurance field offering so many tools to enhance your business, it’s an essential part of modern insurance marketing.

By taking the time to optimize your profile, engage with clients, and ensure your information is accurate, you are positioning your insurance business to succeed in today’s competitive market.