Introduction to Persistency Factor in Health Insurance

The persistency factor in health insurance is a measure of how consistently policyholders renew their health insurance policies over time. It reflects the trust and satisfaction customers have in their insurance provider and is a critical metric for both insurers and policyholders.

Persistency is expressed as a ratio or percentage and is calculated at specific intervals, such as the 13th, 25th, or even the 61st month. For example, the 13th-month persistency ratio measures the percentage of policies renewed after one year of issuance.

High persistency ratios suggest strong customer loyalty and indicate that policyholders find value in their coverage.

Why Persistency is Important

- For Insurers:

- It helps evaluate customer retention and the effectiveness of their sales and service strategies.

- High persistency reduces the cost of acquiring new customers, thereby increasing profitability.

- For Policyholders:

- Renewing policies ensures uninterrupted coverage, avoiding financial risks during emergencies.

- It signifies that policyholders are satisfied with their insurance terms and benefits.

Key Metrics in Persistency

Below is a table summarizing common persistency metrics:

| Persistency Interval | Description |

|---|---|

| 13th Month | Measures retention after the first year. |

| 25th Month | Tracks renewals in the second year. |

| 37th Month | Indicates long-term customer satisfaction. |

| 61st Month | Reflects sustained loyalty and engagement. |

These ratios are useful for insurers to assess product performance and identify areas for improvement.

By understanding the persistency factor in health insurance, insurers and policyholders can work towards more sustainable and beneficial relationships. Maintaining high persistency rates ensures long-term stability and trust in the health insurance ecosystem.

What is the Persistency Factor in Health Insurance?

The persistency factor in health insurance is a critical measure of how consistently policyholders renew their health insurance policies over time. It is represented as a percentage and reflects the proportion of customers who continue paying premiums after their initial purchase.

Persistency is typically measured over different timeframes, such as the 13th, 25th, or 37th month, which indicate the duration of customer retention with the insurer.

Importance of the Persistency Factor

- Indicator of Customer Satisfaction

A high persistency factor shows that customers are satisfied with the insurer’s products, services, and overall experience. When policyholders consistently renew, it suggests trust and value in the offerings provided. - Reflects Product and Service Quality

Persistency is directly linked to the quality of the insurance product and after-sales service. Features like ease of claim settlement, transparency, and competitive premiums can improve persistence rates. - Measures Customer Loyalty

Persistency highlights how loyal customers are to an insurer. Long-term renewals indicate that policyholders view the insurer as reliable and beneficial for their needs. - Impact on Insurer Performance

Insurers with high persistency ratios benefit from reduced acquisition costs, improved profitability, and better resource allocation. Maintaining a loyal customer base also allows insurers to predict revenue and refine underwriting processes.

How Persistency is Measured

Persistency is calculated by tracking the percentage of policyholders renewing their insurance at specific intervals:

- 13th Month: Indicates satisfaction with initial experiences.

- 25th Month and Beyond: Reflects long-term trust and loyalty to the insurer.

Persistency Data

| Measurement Interval | Persistency Ratio (%) | Significance |

|---|---|---|

| 13th Month | 80% | Initial satisfaction and service quality. |

| 25th Month | 70% | Medium-term loyalty and trust. |

| 37th Month | 60% | Long-term satisfaction and reliability. |

Understanding the persistency factor in health insurance helps policyholders choose reliable insurers and enables companies to enhance customer retention strategies.

Importance of Persistency Factor in Health Insurance

The persistency factor in health insurance is a critical metric that benefits both insurers and policyholders. Here’s why it matters:

For Insurers

- Enhances Credibility and Reputation: High persistency rates demonstrate an insurer’s ability to retain customers, reflecting trust and satisfaction among policyholders.

- Impacts Revenue Generation and Financial Stability: When policyholders renew their policies consistently, insurers enjoy stable and predictable cash flow. This helps in better financial planning and achieving economies of scale.

- Indicator of Effective Customer Retention Strategies: Persistency reflects how well an insurer communicates value to customers, ensuring their needs are met and encouraging them to stay.

For Policyholders

- Demonstrates Trustworthiness of Insurers: A high persistency factor assures policyholders that the insurer is reliable and offers quality products.

- Maintains Continuous Health Coverage: Renewing policies ensure that policyholders remain protected without breaks, critical for accessing uninterrupted healthcare benefits.

- Access to Long-Term Benefits and Cost Savings: Many health insurance plans offer rewards such as cumulative bonuses for consistent renewals. Long-term policyholders may also benefit from reduced premium costs.

Key Benefits of Persistency Factor in Health Insurance

| Aspect | For Insurers | For Policyholders |

|---|---|---|

| Financial Impact | Stable revenue and reduced operational costs | Continuous coverage without interruptions |

| Customer Trust | Reflects customer satisfaction and loyalty | Assurance of reliable and trustworthy service |

| Strategic Insights | Helps refine retention strategies and services | Access to cumulative bonuses and lower premiums |

The persistency factor in health insurance not only strengthens the insurer’s business model but also ensures that policyholders gain maximum value and peace of mind over the long term.

Factors Affecting Persistency in Health Insurance

The persistency factor in health insurance is influenced by several interconnected elements that shape policyholder decisions to renew their policies. These factors can be broadly categorized into product-related, customer-related, and insurer-related dimensions.

1. Product-Related Factors

- Benefits Offered: Comprehensive coverage and value-added services can encourage renewals. Policies with limited benefits may push customers toward alternatives.

- Cost and Pricing: Affordable premiums that match the policyholder’s financial capacity are key. Premiums that rise significantly can reduce persistency.

- Competitive Alternatives: The availability of better or cheaper options in the market can lead to policy discontinuation.

2. Customer-Related Factors

- Financial Stability: A policyholder’s ability to pay premiums consistently impacts renewals. Financial hardship often leads to dropped policies.

- Satisfaction and Trust: A positive experience with the insurance provider fosters loyalty and encourages renewals. Dissatisfied customers are likely to switch providers.

3. Insurer-Related Factors

- After-Sales Service: Efficient customer support, such as timely reminders and support during claims, builds trust and improves persistence.

- Claim Settlement Process: Quick and hassle-free claims enhance the customer’s perception of the insurer and encourage continued patronage.

- Transparency: Clear communication about policy terms, costs, and benefits reduces confusion and builds long-term trust.

Factors Impacting Persistency in Health Insurance

| Category | Key Factors | Impact on Persistency |

|---|---|---|

| Product-Related | Benefits, Cost, Competitive Alternatives | Affects perceived value and affordability of the policy |

| Customer-Related | Financial Stability, Satisfaction, Trust | Influences loyalty and ability to continue the policy |

| Insurer-Related | Service Quality, Claim Settlement, Transparency | Builds trust and enhances long-term relationships with policyholders |

These factors collectively highlight why the persistency factor in health insurance is not just a measure of customer retention but a reflection of how well insurers align with policyholder needs. Insurers that address these factors proactively can achieve higher persistency rates, ensuring sustained growth and customer loyalty.

Persistency Ratios and How They Are Measured

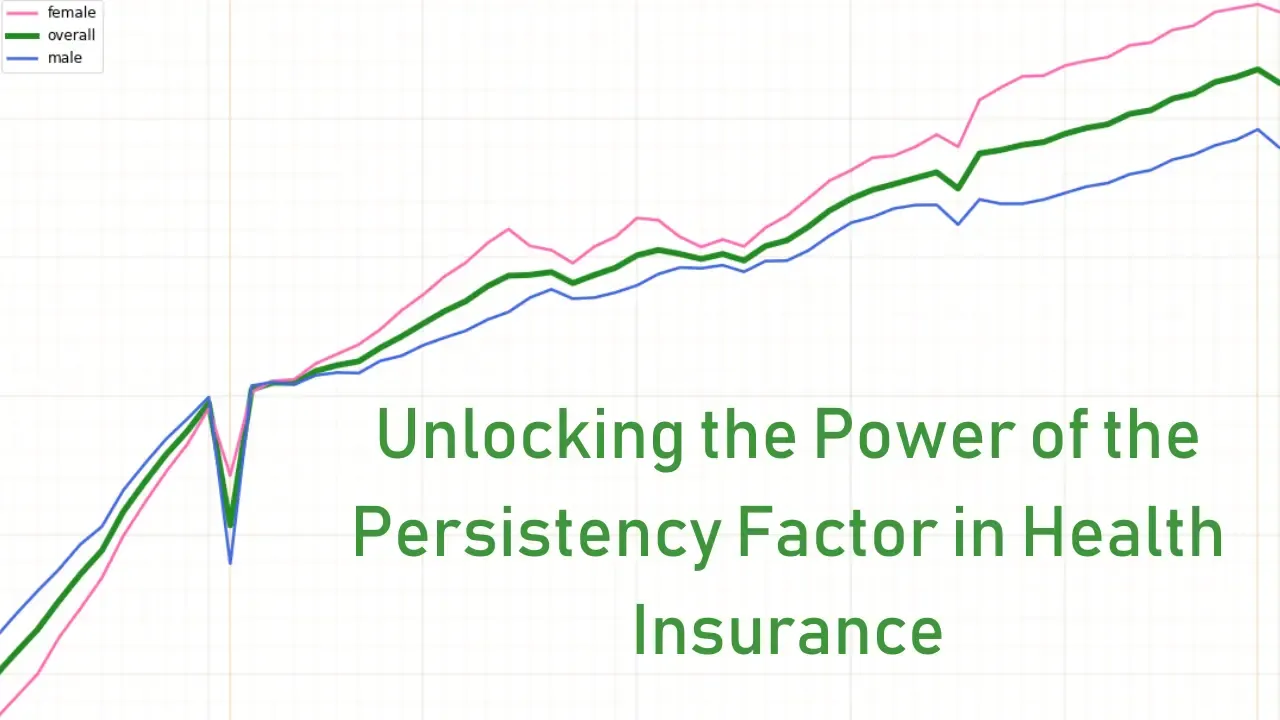

Persistency ratios in health insurance indicate the percentage of policyholders who renew their policies after a given timeframe. These ratios are critical for assessing customer loyalty, satisfaction, and the performance of insurance providers.

The key measurement timeframes are the 13th, 25th, and 61st months, which correspond to one year, two years, and five years after a policy’s inception.

Key Timeframes and Ratios

- 13th Month Persistency: Indicates how many policyholders renew after the first year.

- 25th Month Persistency: Reflects retention at the two-year mark.

- 61st Month Persistency: Highlights long-term loyalty over five years.

These ratios are typically calculated based on the number of policies renewed or the premiums paid during the evaluation period.

Calculation Method

The persistency ratio is computed as:

Persistency Ratio=(Number of policies renewed/Total policies issued in the same period*100)

For example, if 10,000 policies were issued in a specific month, and 8,000 were renewed in the 13th month, the 13th-month persistency ratio is 8000/10000×100=80%

Importance of Persistency Ratios

- Customer Satisfaction: High ratios suggest strong trust and satisfaction among policyholders.

- Revenue Stability: Insurers rely on these renewals for consistent cash flow and financial health.

- Policy Evaluation: Helps insurers understand product competitiveness and customer needs.

Persistency Ratios and Their Indicators

| Timeframe | Indicator | Implications |

|---|---|---|

| 13th Month | First-year retention | Indicates initial customer satisfaction. |

| 25th Month | Two-year loyalty | Shows medium-term customer commitment. |

| 61st Month | Long-term persistency | Reflects insurer trust and long-term value. |

Persistency ratios are vital for insurers to fine-tune their offerings and for customers to gauge the reliability of health insurance providers. Understanding these metrics helps in making informed decisions about maintaining or switching policies.

Challenges in Maintaining a High Persistency Factor in Health Insurance

The persistency factor in health insurance reflects the ability of insurers to retain policyholders over time. However, maintaining a high persistency factor comes with several challenges that impact both insurers and policyholders.

Key Challenges

- Policy Lapses Due to Dissatisfaction and Financial Struggles

Many policyholders discontinue their health insurance due to dissatisfaction with the service or benefits offered. Financial constraints, such as unemployment or rising expenses, further contribute to policy lapses. This is especially prevalent during economic downturns, where individuals prioritize immediate needs over long-term financial commitments. - Impact of Premium Increases

Rising premium rates can discourage renewals. Policyholders, especially those in lower income brackets, may find it challenging to afford the increased costs and seek cheaper alternatives or forego coverage altogether. - Regional and Demographic Variations

Persistency rates vary across regions and demographic groups. For example, younger policyholders might lapse coverage more frequently due to a perceived lack of immediate health risks. In contrast, older individuals often maintain coverage due to greater health concerns. - Competitive Market Pressures

Policyholders are often drawn to competitors offering better benefits, discounts, or promotional offers. This puts pressure on insurers to continuously innovate and improve their services.

Factors Influencing Policy Lapses

| Factor | Description |

|---|---|

| Dissatisfaction | Poor customer service, unfulfilled promises, or limited benefits. |

| Financial Constraints | Job loss, inflation, or unforeseen financial obligations affecting affordability. |

| Premium Hikes | Higher renewal premiums leading to reduced affordability. |

| Demographics | Younger individuals often perceive less value in health insurance. |

| Competitive Offers | Better plans or benefits from rival insurers attract policyholders. |

Maintaining a strong persistency factor in health insurance requires insurers to address these challenges proactively through transparent communication, improved customer service, and competitive pricing strategies.

Strategies to Improve Persistency in Health Insurance

The persistency factor in health insurance is a vital metric for insurers, reflecting customer satisfaction and loyalty. Improving this factor requires targeted strategies focusing on customer needs, policy design, and service delivery.

1. Enhancing Customer Education and Communication

Clear communication builds trust. Insurers should:

- Educate policyholders about policy benefits, terms, and the importance of renewals.

- Provide timely renewal reminders and updates on new products.

- Simplify communication using digital tools like mobile apps and SMS alerts to ensure messages are received effectively.

2. Offering Tailored Policies and Competitive Premiums

Customization improves customer retention:

- Design policies that match individual customer needs, such as family coverage or senior-specific plans.

- Keep premiums competitive by regularly benchmarking against market trends and reducing unnecessary costs.

- Provide flexible payment options, like monthly or quarterly installments, to accommodate varied financial situations.

3. Strengthening After-Sales Services and Claims Processes

Excellent service is critical to maintaining persistence:

- Streamline claims processing to reduce delays and frustration.

- Offer 24/7 support for queries or assistance.

- Use customer feedback to continually improve service quality.

Key Strategies to Improve Persistency in Health Insurance

| Strategy | How It Helps |

|---|---|

| Enhanced Customer Communication | Builds trust, ensures clarity, and reminds customers about renewals. |

| Tailored Policies and Competitive Rates | Meets customer needs and reduces the likelihood of switching insurers. |

| Streamlined Claims and After-Sales Service | Enhances satisfaction and builds long-term relationships with policyholders. |

Improving the persistency factor in health insurance ensures long-term success for insurers and consistent coverage for policyholders. By adopting customer-centric strategies, insurers can foster loyalty and improve their financial stability.

Conclusion: Persistency Factor in Health Insurance

The persistency factor in health insurance plays a vital role in the stability and growth of the insurance industry. It measures how consistently policyholders renew their insurance policies, directly reflecting customer satisfaction and trust in the insurer.

A high persistency rate benefits insurers by providing predictable revenues and reducing costs associated with acquiring new customers. For policyholders, it ensures continuous access to health coverage, long-term benefits, and potentially lower premiums over time.

To maximize the advantages of the persistency factor, insurers need to focus on customer-centric strategies. This includes transparent communication, personalized policy offerings, and streamlined claims processes.

On the other hand, policyholders should prioritize maintaining their policies to secure financial protection and stability during health emergencies.

In summary, the persistency factor in health insurance is a critical metric that fosters a win-win situation for both insurers and policyholders.

By prioritizing this factor, the industry can achieve long-term sustainability while delivering better health outcomes and financial security for individuals.